15.8%-Yielding Icahn Enterprises Stock Better Deal Than Berkshire Hathaway Stock

IEP Stock Ideal for Income & Growth

The recent stock market volatility resulting from the Silicon Valley Bank—aka SVB Financial Group (NASDAQ:SIVB)—and Signature Bank (NASDAQ:SBNY) crises (coupled with ongoing economic headwinds) hasn’t affected all stocks the same. Some stocks continue to make gains and reward buy-and-hold investors with reliable, inflation-crushing dividends. One of the best stocks right now is Icahn Enterprises LP (NYSE:IEP).

Billionaire investor Carl Icahn is the majority owner of the diversified holdings company. He has an 85.5% stake in the $18.0-billion firm.

The partnership has seven operating segments: Automotive, Energy, Investment, Food Packaging, Home Fashion, Pharma, and Real Estate. (Source: “Icahn Enterprises L.P. Investor Presentation: March 2023,” Icahn Enterprises LP, last accessed March 20, 2023.)

Icahn Enterprises invests in public equity and debt securities and pursues an activist agenda. Its largest holdings currently include a 3.3% stake in FirstEnergy Corp (NYSE:FE), worth $796.0 million; a 22% stake in Xerox Hodgins Corp (NASDAQ:XRX), worth $500.0 million; a 12% stake in Herc Holdings Inc (NYSE:HRI), worth $486.0 million; and a 9.9% interest in Southwest Gas Holdings Inc (NYSE:SWX), worth $409.0 million.

Other companies that Icahn Enterprises LP has invested in over the years include Apple Inc (NASDAQ:AAPL), CVR Energy, Inc. (NYSE:CVI), eBay Inc (NASDAQ:EBAY), Herbalife Nutrition Ltd (NYSE:HLF), and Motorola Solutions Inc (NYSE:MSI).

The partnership’s subsidiaries include AAMCO Transmissions Inc., Pep Boys, Precision Auto Care, Inc., Viskase, and WestPoint Home LLC.

Icahn Enterprises LP has a history of making successful exits from businesses, too.

- In 2017, the company sold American Railcar Leasing LLC for $3.4 billion, resulting in a pre‐tax gain of $1.7 billion

- In 2018, it sold Federal‐Mogul for $5.1 billion, resulting in a pre‐tax gain of $251.0 million; Tropicana Entertainment for $1.5 billion, resulting in a pre‐tax gain of $779.0 million; and American Railcar Industries, Inc. for $1.8 billion, resulting in a pre‐tax gain of $400.0 million

- In 2019, it sold Ferrous Resources Limited for about $550.0 million, resulting in a pre‐tax gain of $252.0 million

- In 2021, it completed the sale of 100% of its equity interest in PSC Metals, LLC for $323.0 million, resulting in a pre-tax gain of $163.0 million

In January 2023, Icahn Enterprises filed for voluntary chapter 11 bankruptcy for Auto Parts Holdings LLC, an after-market parts distributor. The bankruptcy proceedings aren’t expected to have a significant impact on Icahn Enterprises.

Icahn Enterprises LP Maintains $2.00 Quarterly Dividend

For the fourth quarter of 2022, Icahn Enterprises announced that its revenue increased by 34% year-over-year to $3.1 billion. The partnership reported a fourth-quarter net loss of $255.0 million, or $0.74 per unit. It also reported a fourth-quarter 2022 adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) loss of $54.0 million, a big improvement from its adjusted EBITDA loss of $443.0 million in the same prior-year period. (Source: “Icahn Enterprises L.P. Reports Fourth Quarter 2022 Financial Results,” Icahn Enterprises LP, February 24, 2023.)

Icahn Enterprises’ full-year 2022 revenue climbed by 24% year-over-year to $13.3 billion. The company’s 2022 net loss was $183.0 million, or $0.57 per unit. Its full-year adjusted EBITDA came in at $758.0 million, compared to $273.0 million in 2021.

On February 22, the board of directors of the general partner of Icahn Enterprises LP declared a quarterly distribution of $2.00 per depositary unit, which works out to a current dividend yield of about 15.8%. In contrast, the average yield of the S&P 500 is just 1.7%.

Icahn Enterprises stock’s dividends will be paid on or around April 19 to investors who were unitholders of record as of the close of business on March 13.

This represents IEP stock’s 71st consecutive quarterly distribution since 2005. The partnership has increased its dividend a number of times, most recently in 2019, when it hiked the dividend from $1.75 to $2.00 per unit.

How can Icahn Enterprises LP continue to pay such frothy dividends when it declares net losses? The company pays its distributions from its investment funds, which it can access on a daily basis. Those funds currently stand at $4.2 billion.

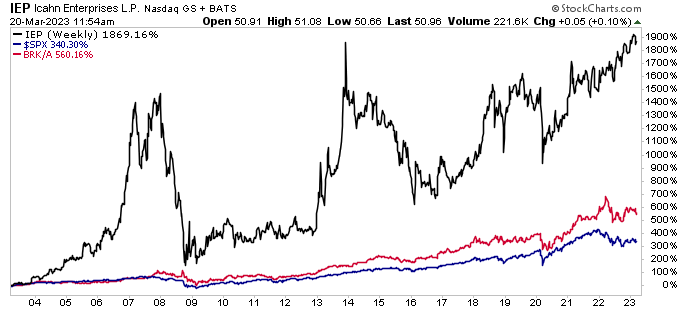

Icahn Enterprises Stock’s Price Outpacing Berkshire Hathaway Stock & S&P 500

Few people would say Carl Icahn has a more storied investment history than Warren Buffett, and there’s no way you can say Icahn Enterprises is a threat to Berkshire Hathaway Inc (NYSE:BRK.B). What you can say is that IEP stock has been seriously outperforming BRK stock and that, unlike Berkshire Hathaway stock, Icahn Enterprises stock pays dividends. For investors who are looking for income and growth in these uncertain times, it’s tough to beat Icahn Enterprises LP.

Trading near record levels, IEP stock is up by:

- Six percent year-to-date

- Five percent over the last six months

- Two percent year-over-year

Meanwhile, the S&P 500 is:

- Up by three percent year-to-date

- Up by 2.5% over the last six months

- Down by 11.5% year-over-year

Chart courtesy of StockCharts.com

Icahn Enterprises stock hasn’t just been kicking the S&P 500 to the curb; it has also been leaving BRK stock in the dust. With dividends reinvested, IEP stock has returned 1,868% in income over the last 20 years, 77% over the last five years, and 24% since the start of 2022.

Over the same time frame, Berkshire Hathaway stock has returned 560%, 57%, and 0.64%, respectively. The S&P 500 has returned 340% over the last 20 years, returned 52% over the last five years, and lost 17% since the start of 2022.

Chart courtesy of StockCharts.com

The Lowdown on Icahn Enterprises LP

Icahn Enterprises is a diversified holding company that continues to reward investors with long-term share-price gains and reliable, inflation-crushing dividends.

As mentioned earlier, Icahn Enterprises stock’s current dividend yield is about 15.8%. Its average dividend yield for the last five years is about 13.4%.