1 Top Dividend Stock for the Next 50 Years

This Top Dividend Stock Yields 4.5%

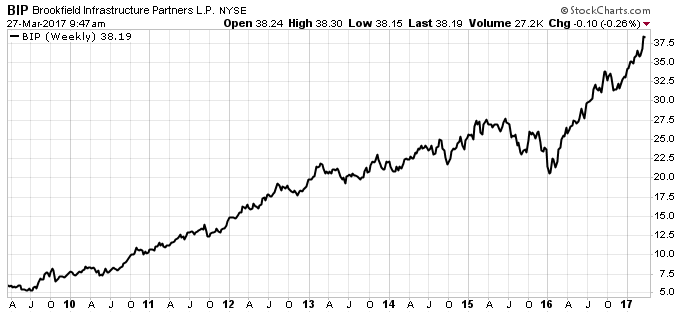

Today’s chart highlights one of our favorite ways to find top dividend stocks: buying forever assets.

I coined the term “forever asset” to describe my favorite group of elite businesses. Their entrenched market position allows them to crank out cash flows year after year. Many of these incredible companies have paid dividends to shareholders for decades.

Case in point: Brookfield Infrastructure Partners L.P. (NYSE:BIP). As a shareholder in this firm, you become the part owner of dozens of infrastructure monopolies around the world. It owns railroads in Australia, electric grids through Canada, and telecommunication towers across Europe. The business makes my list of top dividend stocks for a couple of reasons.

First, these properties gush cash flow. After all, this infrastructure powers the global economy. Without these essential assets, our society would basically grind to a halt. This produces a near-recession-proof stream of profits, regardless of which party controls the White House.

In total, the government regulates about 85% of Brookfield’s revenues. This is a good thing. Governments set rates high to encourage building these expensive projects. Most agreements allow owners to raise prices with inflation. But cash flows from Brookfield look so steady, they resemble bond coupons.

Better still, they have long lives. Infrastructure assets usually get sold through agreements that can range up to 99 years. This is the kind of long-term wealth you can literally pass down through generations.

You won’t find many properties like these anywhere else; I can think of only a handful of businesses in the world with a portfolio of assets like Brookfield’s. But because they’re so valuable, savvy investors tend to take these firms private.

Finally, it’s lucrative. Brookfield has paid out a check to owners for almost a decade. Today units pay a quarterly distribution of $0.44 each, which comes out to an annual yield of 4.5%.

Good news for shareholders. Despite a lack of coverage in the press, the business has quietly made a fortune for owners. If you had invested $1,000 in this top dividend stock in 2008, your position would total $3,300 today.

Source: StockCharts.com

You likely won’t see that kind of performance over the next nine years. I expect that payout, however, will keep growing. Cash-strapped governments around the world must keep selling off their crown jewels to fund deficits. For Brookfield, that should allow them pick up prized assets on the cheap.

Bottom line: Brookfield is one top dividend stocks for the next 50 years. Cash flow just pumps through the business, like some higher-octane fuel than the one other stocks run on. My approach: buy these forever assets, stick the certificates in a drawer, and cash these lucrative dividend checks for decades to come.